Consolidated Dulcie Gold Project.

(100 % Owned)

Overview

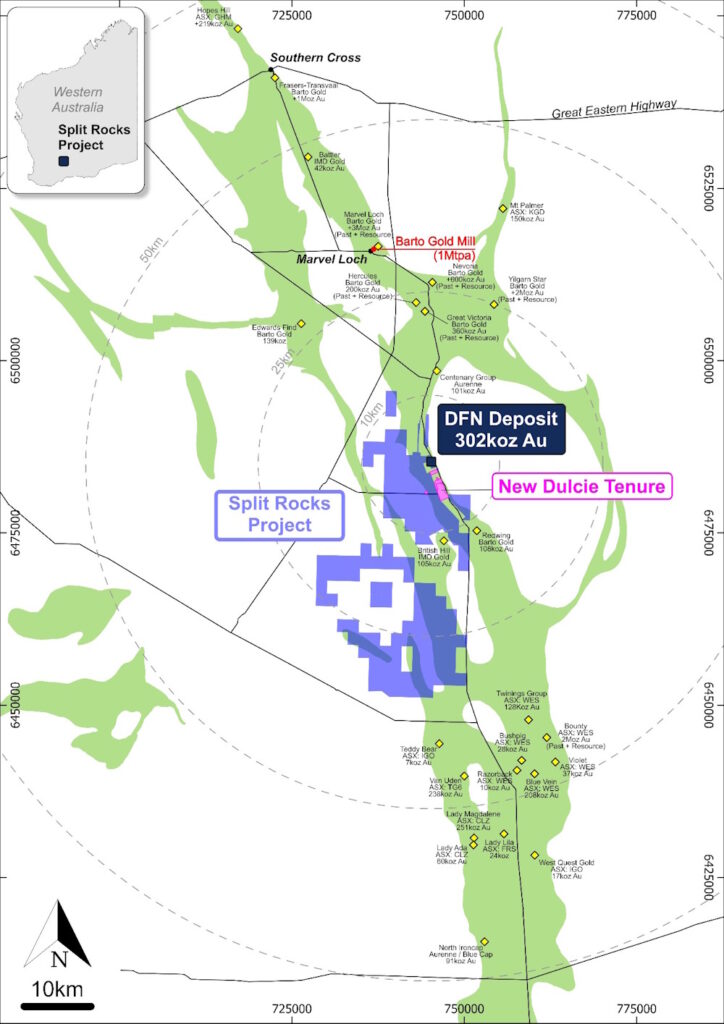

The Consolidated Dulcie Gold Project, wholly owned by Zenith Minerals Limited (ASX: ZNC), is located approximately 400 km east of Perth and 80 km south of Southern Cross within the Southern Cross–Forrestania Greenstone Belt of Western Australia’s Yilgarn Craton. The Project combines the Dulcie Far North (DFN) Mining Lease and Dulcie Subsurface Rights Area, creating a six-kilometre corridor of gold mineralisation along the Dulcie Shear Zone, a structure long recognised for its significant gold endowment and favourable geology.

Zenith’s Inferred Mineral Resource at DFN stands at 8.2 Mt @ 1.15 g/t Au for 302,000 oz (ASX release 23 June 2025), a 41 % increase year-on-year. The broader Consolidated Dulcie corridor also hosts a defined Exploration Target of 0.3–0.8 Moz Au (10–24 Mt @ 0.9–1.1 g/t Au) (ASX release 15 July 2025), highlighting strong potential for further resource growth through ongoing drilling.

Located within an established mining district serviced by multiple operating gold plants, Dulcie offers a clear, low-capital pathway to production and near-term development. Proximity to the Barto Marvel Loch and Eda May processing plants (~40 km) enables potential toll-treatment options, reducing capital intensity and allowing Zenith to focus on rapid resource growth and early cash-flow generation.

The Project benefits from:

- Established Infrastructure and Access: Direct sealed-road access and proximity (~35 km) to the Barto Marvel Loch and Eda May processing plants provide potential toll-treatment options, supporting a low-capital, fast-track pathway to production.

- Favourable Tenure and Permitting: The Project comprises granted Mining Leases with existing heritage clearances, access agreements, and a proven permitting framework, enabling a streamlined transition from exploration to development.

- Active Mining Operations De-risk Development: The Mining Leases contain ongoing heap-leach mining operations, confirming approved permitting pathways and demonstrating that mineralisation is already amenable to mining. These operations significantly de-risk future exploration and underpin a rapid route to resource expansion.

- Excellent Regional Infrastructure: Nearby grid power, established haulage routes, and proximity to Southern Cross (~80 km) for workforce and logistics further strengthen the Project’s development readiness and economic potential.

- Strategic Option and Royalty Structure:

Zenith retains a clearly defined call option to acquire either the subsurface rights or full ownership of the Dulcie tenements within five years, under milestone-based terms. The structure includes a 2 % Net Smelter Return (NSR) royalty on future gold production below 8 m depth, with the option to extinguish the royalty upon full acquisition, providing long-term flexibility and a pathway to complete ownership.

Zenith acquired the granted DFN Mining Lease (M77/1292) in January 2023, securing 100 % of gold rights below 6 m and all other mineral rights (including lithium) from surface.

Current Drilling Programme

Building on the success of Phase 1, Zenith has mobilised two RC rigs for a major 9,000–12,000 m Phase 2 drilling programme across the Consolidated Dulcie corridor. Announced on 9 July 2025 (ASX ZNC – Rights Issue Completion) and expanded following PoW approval on 26 August 2025, this campaign represents the most extensive drilling effort undertaken at Dulcie to date.

As illustrated in Figure 2, the Phase 2 programme focuses on open extensions to the north and south of the known resource area. Red annotations highlight the interpreted continuation of DFN-hosting stratigraphy southward and Dulcie mineralisation northward, both of which remain untested and will be key priorities in this campaign.

The programme will:

- Infill and step out across DFN, Dulcie North, and the southern extensions to expand known mineralised zones and improve geological confidence.

- Test untested flexure zones, footwall lodes, and Banded Iron Formation (BIF) horizons identified from detailed structural modelling, targeting new high-grade positions along the shear corridor.

- Systematically evaluate the 0.3–0.8 Moz Exploration Target areas (see Table 2 below), with drilling designed to convert material portions into JORC-compliant Mineral Resources.

Figure 2: Plan of the Consolidated Dulcie corridor highlighting open extensions north and south. Red annotations show the interpreted continuation of DFN hosting stratigraphy southward and Dulcie mineralisation northward, both of which remain to be drill-tested.

Mineral Resource Estimate – Dulcie Far North

The Dulcie Far North (DFN) Mineral Resource, updated 23 June 2025, stands at 8.2 Mt @ 1.15 g/t Au for 302,000 ounces (Inferred) — an increase of ~101 % over the 150 koz maiden Resource reported in 2023. The upgrade followed systematic drilling across 2024–25, providing sufficient data density and confidence to support a revised estimate.

Resource Category | Tonnes (Mt) | Grade (Au g/t) | Contained Gold (oz) |

Inferred | 8.2 | 1.15 | 302,000 |

Table 1: Dulcie Far North (DFN) Inferred Mineral Resource – ASX Release 23 June 2025. Cut-off grade: 0.5 g/t Au. Prepared and reported in accordance with the JORC Code (2012 Edition). The Mineral Resource was estimated by Mr John Horton FAusIMM (CP), ResEval Pty Ltd, and approved for release by ZNC.

Zenith acquired the granted DFN Mining Lease (M77/1292) in January 2023, securing 100 % of gold rights below 6 m and all other mineral rights (including lithium) from surface.

Exploration Target – Consolidated Dulcie Gold Project

On 15 July 2025, Zenith announced a significant Exploration Target for the Consolidated Dulcie Gold Project (ASX ZNC “Significant Exploration Target Defined at Dulcie Gold Project”).

The Target covers the Dulcie Far North (DFN) Mining Lease (M77/1292), Dulcie North (DN), and the newly secured southern subsurface rights area, representing a continuous six-kilometre corridor of mineralisation along the Dulcie Shear Zone.

Independent consultants modelled the Exploration Target using validated drill data, surface geochemistry, and structural interpretations derived from both Zenith and historical datasets. The resulting range, summarised in Table 2, outlines a potential 0.3 – 0.8 million ounces of contained gold within 10 – 24 million tonnes grading 0.9 – 1.1 g/t Au, demonstrating the scale potential of the consolidated corridor and highlighting multiple opportunities for near-term resource expansion.

Area | Tonnage Range (Mt) | Grade Range (Au g/t) | Contained Gold Range (M oz) |

Dulcie | 8 – 17 | 0.9 – 1.1 | 0.2 – 0.6 |

Dulcie North (DN) | 1 – 2 | 0.9 – 1.1 | 0.05 – 0.1 |

Dulcie Far North (DFN) | 1 – 2 | 0.9 – 1.1 | 0.05 – 0.1 |

Total | 10 – 24 | 0.9 – 1.1 | 0.3 – 0.8 |

Table 2: Consolidated Dulcie Exploration Target – ASX Release 15 July 2025. Cut-off grade: 0.5 g/t Au. Prepared and reported in accordance with the JORC Code (2012 Edition). The Exploration Target was compiled by Mr Daniel Greene MAIG, Zenith Minerals Limited, and approved for release by the Company.

Confirmed Gold System: Drilling by Zenith in 2020–2021 confirmed the southern continuation of the DFN gold system into the broader Dulcie corridor, establishing strong geological continuity and the presence of high-grade mineralisation within multiple stacked lodes.. Notable intercepts include:

- 32m @ 9.4 g/t Au from 14m, including 9m @ 31.4 g/t Au from 17m (ZAC153, ASX ZNC 2 December 2020)

- 14m @ 3.5 g/t Au from 46m, including 3m @ 5.6 g/t Au and 4m @ 6.7 g/t Au (ZAC209, ASX ZNC 2 December 2020)

- 18m @ 2.0 g/t Au from 25m, including 1m @ 23.7 g/t Au (ZAC162, ASX ZNC 2 September 2020)

JORC Exploration Target Cautionary Statement

The potential quantity and grade of the Exploration Target are conceptual in nature.

There has been insufficient exploration to estimate a Mineral Resource, and it is uncertain whether further exploration will result in the estimation of a Mineral Resource.

Competent Persons Statement

The information in this section that relates to Exploration Results and Exploration Targets is based on information compiled by Mr Daniel Greene, a Member of the Australasian Institute of Geoscientists and an employee of Zenith Minerals Limited. Mr Greene has sufficient experience relevant to the style of mineralisation and type of deposit to qualify as a Competent Person under the 2012 JORC Code and consents to its inclusion in the form and context in which it appears.

The Mineral Resource information is compiled by Mr John Horton, FAusIMM (CP), of ResEval Pty Ltd, who consents to the inclusion of the data in the form and context presented.

Relevant ASX Releases

- 10 June 2025 – Strategic Acquisition of Subsurface Rights and Option Agreements to Expand Dulcie Gold Project

(Secured exclusive subsurface exploration and mining rights, plus milestone-based call options over full ownership.) - 23 June 2025 – 41 % Increase in Mineral Resources at Dulcie Far North

(Updated Inferred MRE: 8.2 Mt @ 1.15 g/t Au for 302,000 oz, confirming significant resource growth and continuity.) - 15 July 2025 – Significant Exploration Target Defined at Consolidated Dulcie Gold Project

(Exploration Target: 0.3–0.8 Moz Au, outlining corridor-scale potential for resource expansion.) - 26 August 2025 – PoW Approval Unlocks Phase 2 Drilling at Consolidated Dulcie Gold Project

(Programme approval enabling 9,000–12,000 m RC drilling across Dulcie, Dulcie North, and DFN.)

Definitions

- Dulcie Far North (DFN): Mining Lease M77/1292, acquired by Zenith in January 2023 (ASX release: 25 January 2023).

- Dulcie Tenement Package: Subsurface rights held under agreement with Highscore-RRA, covering Mining Leases M77/581, M77/1246, M77/1250, M77/1267, M77/1290 and Miscellaneous Licences L77/226, L77/244, L77/256.

- Highscore-RRA: Vendors Highscore Pty Ltd and Richard Read and Associates Pty Ltd, counterparties to Zenith’s 2025 subsurface rights and option agreements (ASX release: 10 June 2025).